DETR: Corrected 1099-Gs will come, but not fast

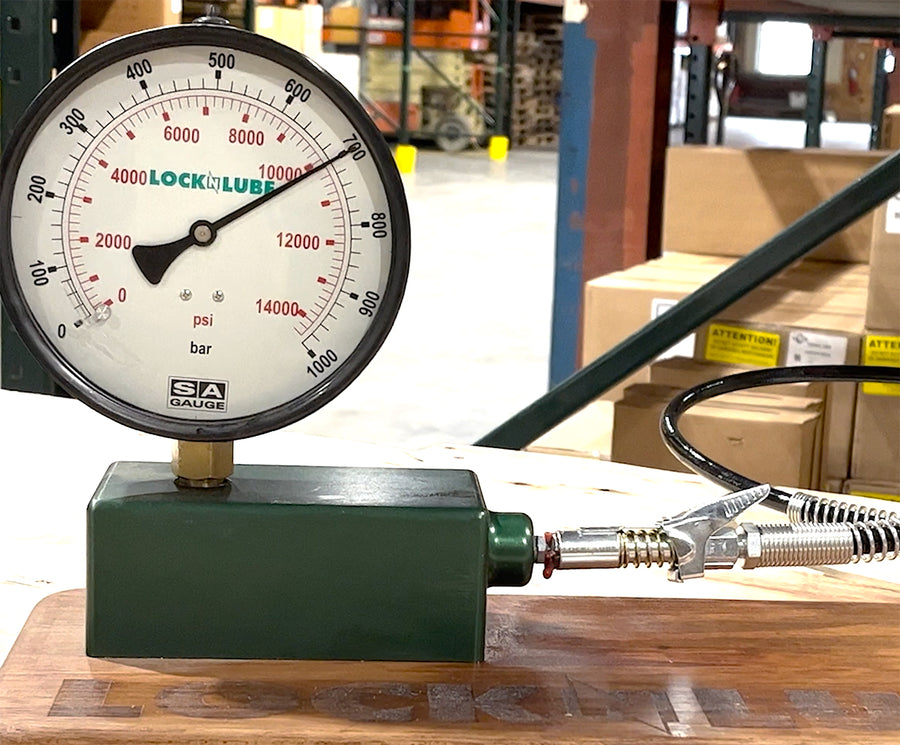

4.8 (524) · $ 17.99 · In stock

Donovan Thiessen never filed for unemployment last year, but got a letter from DETR saying he did. He was a victim of fraud: a scammer pretended to be him and may have gotten unemployment money in his name. "Aside from the income tax headache that's probably going to happen, now I have an identity theft issue perhaps," he said. Thiessen notified DETR, but because it was so overwhelmed earlier this year, it may or may not have caught the problem.

Intracellular signaling pathways of muscarinic acetylcholine receptor-mediated detrusor muscle contractions

3.41.269 Information Returns Processing on SCRIPS

Global, regional, and national comparative risk assessment of 79 behavioural, environmental and occupational, and metabolic risks or clusters of risks, 1990–2015: a systematic analysis for the Global Burden of Disease Study 2015 - The Lancet

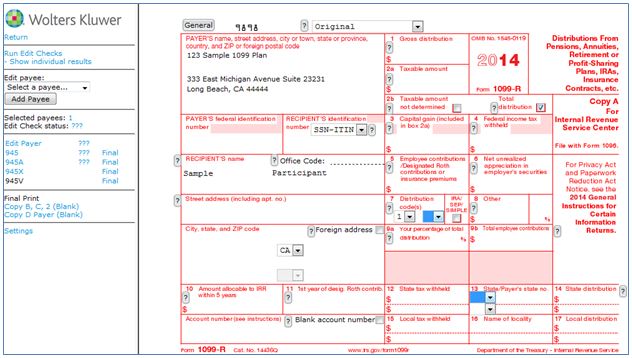

1099 Software User Guide

How to Correct Form 1099-nec with ezW2 Software

Taxes, IRS may be next headache for Nevadans battling DETR

How to file 1099 and W-2 amount corrections (after IRS/SSA filing) – eFileMyForms

5.19.1 Balance Due Internal Revenue Service

How to file 1099, 1098, W-2, 1042-S corrections – eFileMyForms

How do I void a 1099 that was filed?

What if I received a 1099-G Form and I do not agree with the amounts? The 1099-G includes your weekly benefit amount paid plus all stimulus payments, By Detr Nevada

IRS Forms 1099 - Wait For the Corrected 1099 Before Filing Taxes!!

DETR overpayment notices concern claimants

![How Do I Pick the Right Resume Paper? [All You Need to Know!]](https://cdn-blog.novoresume.com/articles/resume-paper/bg.webp)