Tax Benefits for Child Daycare Providers and Users – Henssler Financial

4.6 (451) · $ 12.99 · In stock

Special tax benefits are available for those providing daycare services for children and the parents who pay for those services. We take a look at the various tax deductions daycare providers may use and the childcare tax credit that the parents may claim.

Tax Benefits for Child Daycare Providers and Users – Henssler Financial

Tax Benefits for Child Daycare Providers and Users

Dependents, Child Tax Credit, Additional Child Tax Credit, & Other

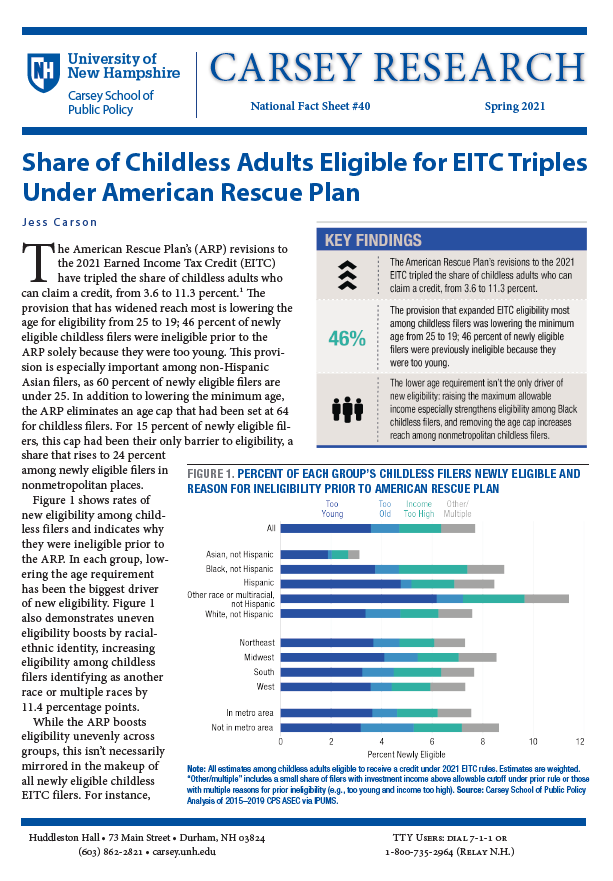

Share of Childless Adults Eligible for EITC Triples Under American

T21-0053 – Tax Benefit of the Child and Dependent Care Tax Credit

Donate - Hushabye Nursery

Save Up To $1,850 Each Year With a Dependent Care FSA!

Child Welfare

Dependent Care Spending Accounts (DCSA)

Child Care Tax Savings 2021 - Curious and Calculated